This blog is curated by @jan_skoda, founder of crypto market maker LiquidityLabs and former Head of Research at Quantlane (owned by FTMO). All research is done on Crypto Lake historical market data.

Building HFT algos with hftbacktest and Lake

Come back later for: Backtest high-sharpe HFT strategies with hftbacktest integrated with Lake

New posts are announced on RSS, X/twitter @jan_skoda or @crypto_lake_com, so follow us!

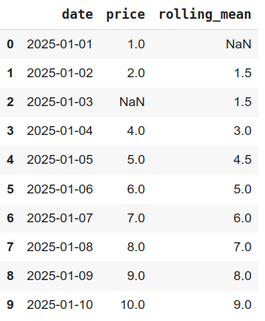

Working with missing data in time-series processing

Missing data often cannot be avoided, especially when working with time series. If we however handle them properly, we can minimize their impact on results. Here is how to do it using Pandas library and its NaN handling machinery.

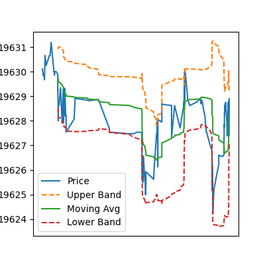

Integrating Custom Trading Indicators with Pandas

How to implement common trading indicators using Pandas/NumPy and extend Pandas objects with custom methods for computing those indicators for seamless financial analysis.

Common backtesting problems and how to avoid them

Backtesting is arguably the most important part of quantitative research. Its precision is critical for decision making in the research process. For certain kinds of strategies, backtesting precision can be very high and the results trustworthy, but some backtests should not be trusted at all. How to distinguish between the two?

Market maker's edge in the market

Many people accuse market makers or HFTs of unfairly benefiting from the market or retail investors. Is this true and what advantages do these market participants have in the cryptocurrency market. And how can other algo-traders compete with them?

Analysing overfitting on individual model features

Overfitting is one of the biggest adversaries of quantitative researchers. Today, we will zoom in into our models and find out which features are useful and which are causing the biggest harm.