Quant strategy overfitting intro

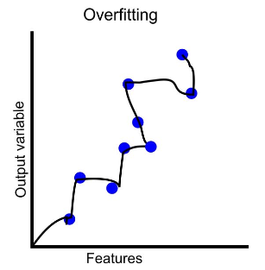

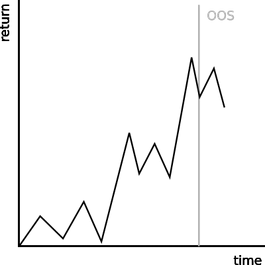

In trading, overfitting means that your model or backtest will seem to perform great on historical data, or backtest, but perform poorly on live trading data. This can make you implement a poor trading strategy or allocate more capital to a model than you should. Both are costly mistakes.

Does selling backtests work?

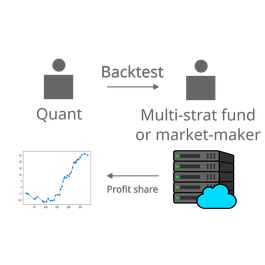

Sometimes we are approached by quants with a great backtest. They either want to sell their strategy or ask us to implement it and give them a share of the profits. (How) does this model work?

Tips and tricks to avoid overfitting in trading

Overfitting can cost you a lot of time and money. Here are a few trading-related tricks to avoid overfitting that are not known outside the algo-trading community.

Analysing overfitting on individual model features

Overfitting is one of the biggest adversaries of quantitative researchers. Today, we will zoom in into our models and find out which features are useful and which are causing the biggest harm.