Market maker's edge in the market

On 09 October 2024 - tagged market-making

Many people accuse the evil market makers or HFTs of unfairly benefiting from the market or retail investors. Is this true and what advantages do these market participants have in the cryptocurrency market? Do they bring some value to the market for the money they make? And how can other algo-traders compete with them?

Market makers utility #

Market makers ensure there is enough liquidity in the market. In the short term it means that there are enough bid and ask orders in the order book to satisfy bigger market orders without moving the price too much. Without enough market makers, the price would be volatile, and spreads wide, making trading more expensive and risky for everyone.

For this, market makers are rewarded with negative maker fees (rebates) from the exchange and captured spreads.

Market makers edge #

The main advantage of market makers is that they have zero or negative maker fees and can execute any other potentially directional strategies (e.g. trend following) without any fees. They can simply skew their bid-ask quotes e.g. by shifting their middle price (often called fair price). While other market participants would pay an exchange fee for executing such a strategy, market makers can do that free of charge or even get paid for it.

How can other algo-traders compete? #

So assume you were a small algo-trader with a pretty good 4 bps maker fee on Binance spot. The market maker would have over 4 bps edge over you and possibly even lower latency. Your model would have to be pretty good to beat this. All the quants at the market making firms contributing to the final algorithm would have a serious advantage over you, especially in the mid-to-high frequency strategies, where fees are significant. And those most active strategies are the ones where you can make serious returns even on small capital and also in a reliable way (high sharpe ratio).

You could move into the low-frequency realm, but then your returns might drop to (possibly low) double digits, which doesn't make much sense for an algo trader with limited capital. You would have to be pretty efficient or raise more capital to pay for your own time spent on strategy development and operations.

You could also team-up with a market maker and trade through them: using their fees and most likely also their capital. This is efficient especially for scalable high-frequency signals. This has other issues though: you would have to prove to the market maker that your strategy (usually in the form of backtest) is good, which is pretty hard to prove as discussed in Does selling backtest work?. You have a good chance only if you already have a good track record in CV or you approach a small market maker for which your strategy's PnL might be significant. (Note: we also run market making strategy and accept strategy proposals, feel free to reach out to me on Twitter.)

Advantages of long-term institutional traders / funds #

In general, institutions have much more advantages over the market. Sophisticated investors can afford to spend tens or hundreds of hours of work on analysis of individual stocks before they invest. They can approach the management of the target company and ask for information or clarification of publicly available data. All this time pays off due to the volume of the investment. Retail investors cannot afford this and have to rely on their 'feeling', influencers or public analyst ratings and articles. Institutions can even leverage the influenceable investors by publishing recommendations or news releases to make retail buy when they want to sell their positions.

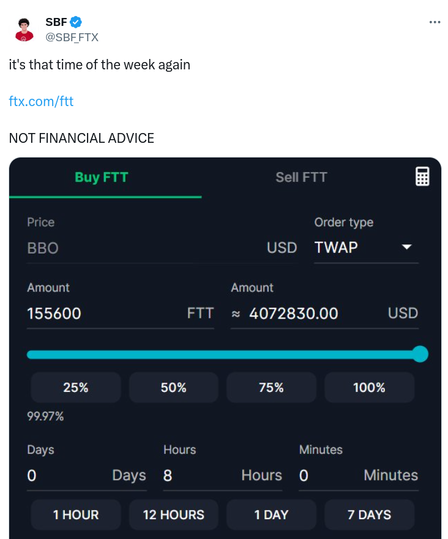

Here's a famous example of SBF desperately trying to save the huge FTT bags of Alameda and FTX:

New posts are announced on X/twitter @jan_skoda or @crypto_lake_com, so follow us!