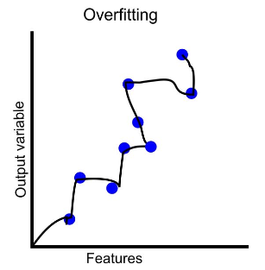

Tips and tricks to avoid overfitting in trading

Overfitting can cost you a lot of time and money. Here are a few trading-related tricks to avoid overfitting that are not known outside the algo-trading community.

Algo-trading resources - online

Here are few online resources that I have found useful for algo-trading. Strategy ZOO, analysis mashup, historical hft data provider and podcasts included!

Algo-trading resources - books

Starting with algo-trading is hard. As this field is highly competitive and quickly evolving, there are not many quality resources available and those at hand are often of varying quality. This page is a collection of resources that I have found useful.

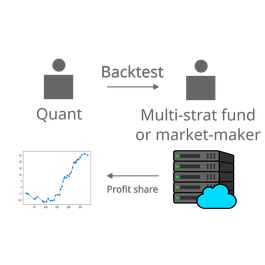

Does selling backtests work?

Sometimes we are approached by quants with a great backtest. They either want to sell their strategy or ask us to implement it and give them a share of the profits. (How) does this model work?

Quant strategy overfitting intro

In trading, overfitting means that your model or backtest will seem to perform great on historical data, or backtest, but perform poorly on live trading data. This can make you implement a poor trading strategy or allocate more capital to a model than you should. Both are costly mistakes.

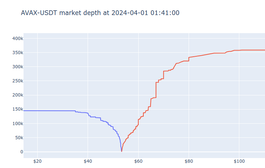

Plotting cumulative orderbook in Python

Simple function for plotting cumulative orderbook in Python with Python and Plotly