Integrating Custom Trading Indicators with Pandas

On 18 February 2025 - tagged resources, python

Pandas has become the de facto standard for financial data analysis in Python. Its powerful data structures and efficient operations make it ideal for working with time series data. However, while pandas comes with many built-in functions, traders often need custom technical indicators for their analysis. In this post, we'll explore how to implement common trading indicators using NumPy and pandas in computationally efficient way and integrate them with Pandas dataframes seamlessly for convenience.

Let's start by defining a few utility functions that we'll use for efficient computation of the indicators:

Utility Functions #

Efficient Rolling Window Calculations #

When working with financial time series, we often need to calculate metrics over a rolling window of data. The naive approach of iterating through the data can be slow, especially with large datasets. Instead, we can use NumPy's stride tricks to create efficient rolling window views of our data:

def numpy_rolling_window(data, window):

shape = data.shape[:-1] + (data.shape[-1] - window + 1, window)

strides = data.strides + (data.strides[-1],)

return np.lib.stride_tricks.as_strided(data, shape=shape, strides=strides)

@numpy_rolling_series

def numpy_rolling_mean(data, window, as_source=False):

return np.mean(numpy_rolling_window(data, window), axis=-1)

def rolling_mean(series, window, min_periods=None):

min_periods = window if min_periods is None else min_periods

if min_periods == window and len(series) > window:

return numpy_rolling_mean(series, window, True)

else:

try:

return series.rolling(window=window, min_periods=min_periods).mean()

except Exception as e:

return pd.Series(series).rolling(window=window, min_periods=min_periods).mean()The Decorator Pattern #

To make our indicator functions work seamlessly with both raw NumPy arrays and pandas Series, we use a decorator pattern:

def numpy_rolling_series(func):

def func_wrapper(data, window, as_source=False):

series = data.values if isinstance(data, pd.Series) else data

new_series = np.empty(len(series)) * np.nan

calculated = func(series, window)

new_series[-len(calculated):] = calculated

if as_source and isinstance(data, pd.Series):

return pd.Series(index=data.index, data=new_series)

return new_series

return func_wrapperThis pattern allows us to write our core indicator logic using NumPy for performance, while still maintaining pandas compatibility.

Indicator Examples #

True Range #

The True Range indicator measures market volatility, taking into account gaps between periods:

def true_range(bars):

return pd.DataFrame({

"hl": bars['high'] - bars['low'],

"hc": abs(bars['high'] - bars['close'].shift(1)),

"lc": abs(bars['low'] - bars['close'].shift(1))

}).max(axis=1)Average True Range (ATR) #

The ATR is a moving average of the True Range, commonly used to measure market volatility:

def atr(bars, window=14):

tr = true_range(bars)

res = rolling_mean(tr, window)

return pd.Series(res)Relative Strength Index (RSI) #

The RSI is a momentum oscillator that measures the speed and change of price movements:

def rsi(series, window=14):

deltas = np.diff(series)

seed = deltas[:window + 1]

ups = seed[seed > 0].sum() / window

downs = -seed[seed < 0].sum() / window

rsival = np.zeros_like(series)

rsival[:window] = 100. - 100. / (1. + ups / downs)

for i in range(window, len(series)):

delta = deltas[i - 1]

if delta > 0:

upval = delta

downval = 0

else:

upval = 0

downval = -delta

ups = (ups * (window - 1) + upval) / window

downs = (downs * (window - 1.) + downval) / window

rsival[i] = 100. - 100. / (1. + ups / downs)

return pd.Series(index=series.index, data=rsival)Bollinger Bands #

Bollinger Bands consist of a moving average and (usually) two standard deviation bands, used to identify overbought/oversold conditions:

def bollinger_bands(series, window=20, stds=2):

ma = rolling_mean(series, window=window)

std = rolling_std(series, window=window)

upper = ma + std * stds

lower = ma - std * stds

return pd.DataFrame(index=series.index, data={

'upper': upper,

'mid': ma,

'lower': lower

})Z-Score #

The Z-Score measures how many standard deviations a price is from its mean, useful for identifying extremes. Note that this implementation is not forward looking thanks to using rolling statistics!

def zscore(series, window=20, stds=1):

std = numpy_rolling_std(series, window)

mean = numpy_rolling_mean(series, window)

return (series - mean) / (std * stds)Pandas Integration #

To make our indicators easily accessible in pandas workflows, we can extend the PandasObject class:

from pandas.core.base import PandasObject

PandasObject.true_range = true_range

PandasObject.atr = atr

PandasObject.rsi = rsi

PandasObject.bollinger_bands = bollinger_bands

PandasObject.zscore = zscoreNow we can use these indicators directly on our DataFrame objects:

df['ATR'] = df.atr(window=14)

df['RSI'] = df.rsi(window=14)Practical Example #

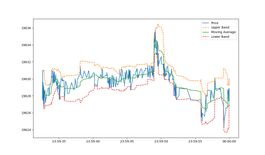

Let's apply these indicators to BTC prices from Crypto Lake free dataset:

import lakeapi

import matplotlib.pyplot as plt

# Get free sample data

lakeapi.use_sample_data(anonymous_access = True)

data = lakeapi.load_data(

table = 'trades',

exchanges = ['BINANCE'],

symbols = ['BTC-USDT']

).set_index('origin_time')

data = data.iloc[-1000:] # Select just a few minutes of trades

# Calculate indicator

bands = data['price'].bollinger_bands(window=50)

# Plot results

plt.plot(data['price'], label='Price')

plt.plot(bands['upper'], label='Upper Band', linestyle='--')

plt.plot(bands['mid'], label='Moving Average')

plt.plot(bands['lower'], label='Lower Band', linestyle='--')

plt.legend()

plt.show()

Conclusion #

Full code in a single python file can be downloaded here. If you save the file, delete the usage in the bottom part and then import the module in your notebooks/analyses, you can build a convenient indicator library for your use-cases.

New posts are announced on X/twitter @jan_skoda or @crypto_lake_com, so follow us!